If you’re looking at your financial aid package and feeling a little overwhelmed about how to make sense of it all, we’re here to help. Let’s make sense of your financial aid package together.

Three Key Components of Your Package

Experts agree that your financial aid offer should include the following components (but be aware that not all schools follow these principles):

#1 – Estimated Annual Costs

Also known as your “Cost of Attendance” (COA), this will include: Tuition & Fees

- Living Expenses (Food & Housing)

- Books and Course Materials, Supplies and Equipment

- Transportation

- Personal Expenses

- Federal Loan Fees

- Professional Licensure, Certification or Credentialing Costs (if applicable)

Yearly costs make up in part or all of the “sticker price” of a college, or what the cost to attend is before factoring in any aid or loans.

#2 – Financial Aid Available to You

This section is separated into groups based on each type of assistance:

- Gift Aid, such as scholarships and grants. This is financial aid that reduces your actual costs, and you don’t have to repay it.

- Federal student loans. Students must complete the Free Application for Federal Student Aid (FAFSA) to be eligible for federal student loans. These loans generally must be repaid when a student is no longer enrolled at least half-time, but the terms of federal student loans include benefits such as fixed interest rates, flexible repayment options, and student loan forgiveness programs. These loans have annual borrowing limits that are based on a student’s grade level and dependency status.

- Other loans. Private education loans or Federal Direct PLUS Loans for Parents are additional borrowing options and usually require credit approval. These loans must be repaid, usually when the student is no longer enrolled. The terms available through a private loan will depend on your credit (and any cosigners) as well as the lender that you choose. Students should “shop around” and do their research to find a lender that offers the lowest interest rate or other loan terms. Many schools provide a private lender list that may help you identify good options. Terms for the Federal Direct PLUS Loan for Parents are set by law. A student must complete a FAFSA for a parent to borrow a Parent PLUS Loan on their behalf.

- Student Employment: Part-time student employment that may be available to the student in the form of an on-campus or work-study job.

#3 – Estimated Net Price

This is your estimated annual costs (Cost of Attendance) minus your gift aid (scholarships & grants).

If the financial aid offer that you receive does not contain all of these components, you can reach out to the financial aid office at that school to request this information.

Key Words and Definitions

Financial aid offers sometimes contain jargon that can be confusing, and below are explanations of some common terms you may see in financial aid offers from some schools:

- Direct costs: This means billed costs such as tuition and fees, and campus housing and meals for students residing on campus. These costs are part of your estimated annual expenses (cost of attendance).

- Indirect costs: These are expenses a school estimates you may have, such as books, transportation, or food and housing for students who are not residing in campus housing. These costs are also part of your estimated annual expenses (cost of attendance).

- Self-Help Aid: This refers to student employment or student loans.

- Subsidized or Unsubsidized: Federal student loans that are subsidized accrue no interest during a student’s enrollment or grace period. Students must have financial need to qualify for a Subsidized loan. Unsubsidized loans begin accruing interest when the loan is disbursed.

- Student Aid Index (SAI): This is the number calculated by the FAFSA and is used to determine eligibility for need-based assistance. A lower SAI will result in greater eligibility for need-based assistance.

Examples of financial aid packages

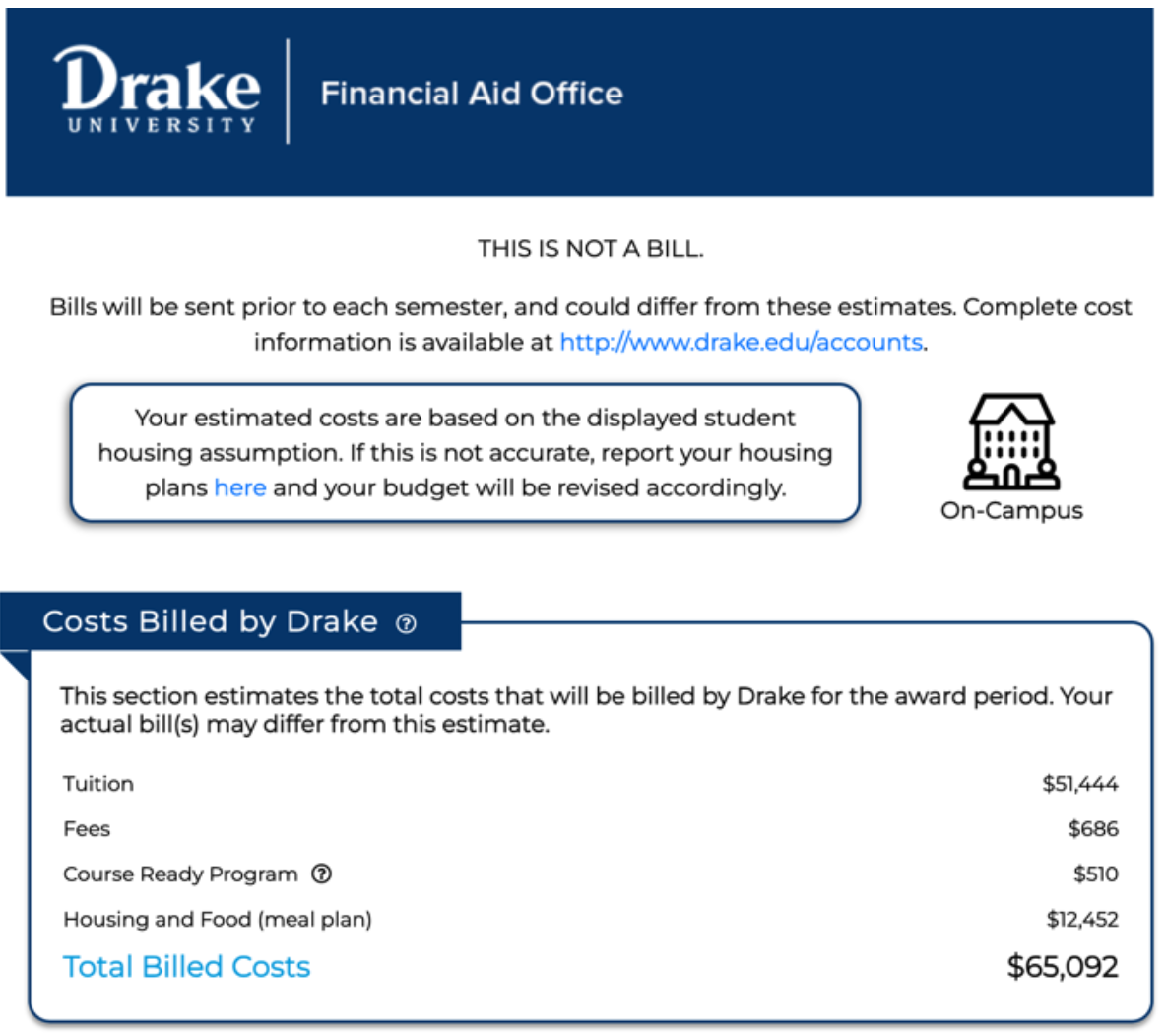

“Costs Billed by Drake” will include estimated tuition and fees, as well as room and meal plan costs for students who will live in campus housing. Undergraduate students at Drake have the opportunity to take advantage of Course Ready, which provides all of a student’s required books and course materials for all of their classes for a billed charge of $255/semester.

Students that opt out of Course Ready will still have an allowance for books, but it would be included in their cost of attendance budget as an indirect cost (not billed by Drake).

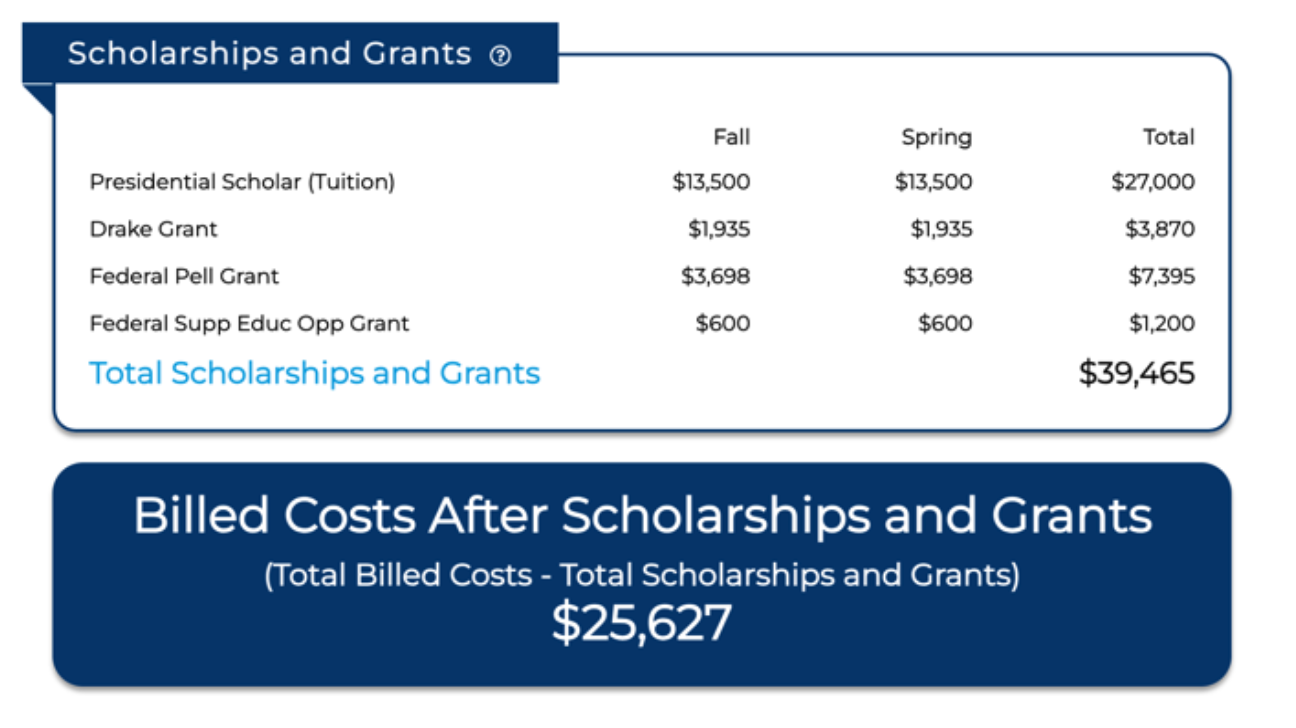

Scholarships and Grants reduce your actual cost, and do not need to be repaid. In this example, the student’s total scholarships and grants are $39,465. Scholarships and grants are applied as payments on a student’s bill, and therefore the estimated billed cost after scholarships and grants is $25,627.

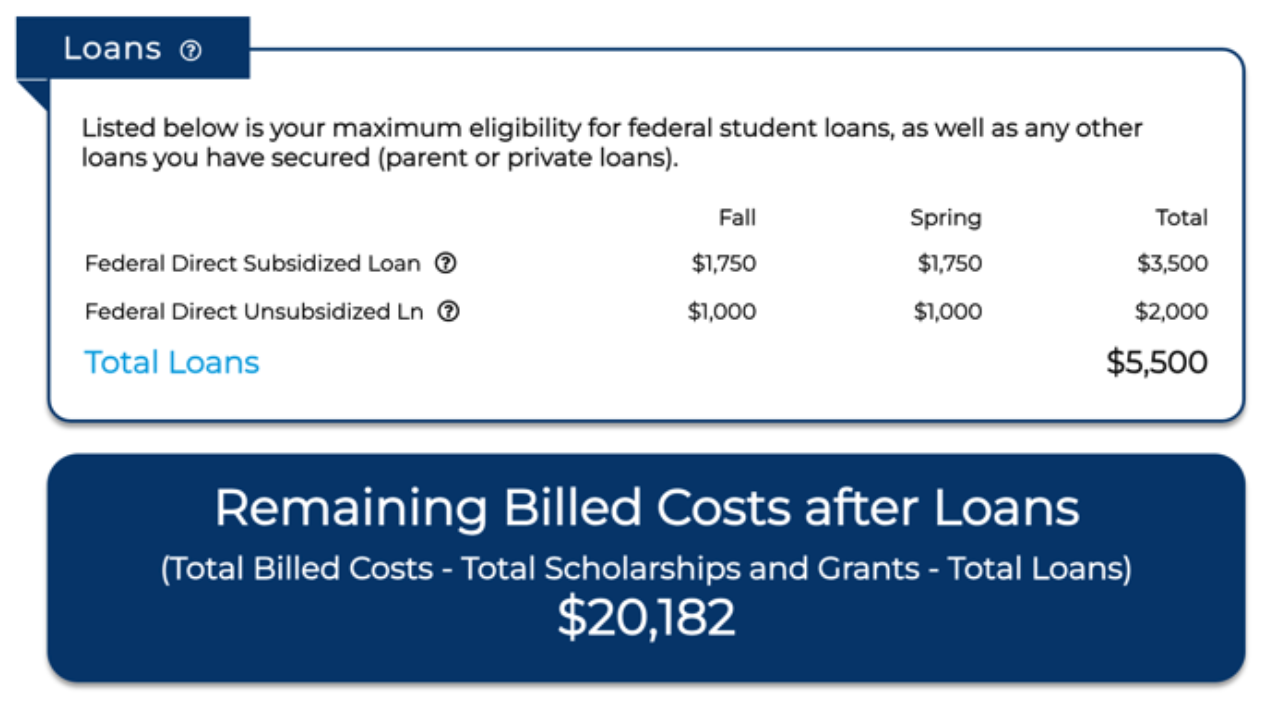

Students who submit a FAFSA are offered the maximum amount of federal student loans available to them. In this example, the student qualifies for a Subsidized loan of $3,500 (no interest accrues during enrollment and grace period) and an Unsubsidized loan of $2,000 for the academic year, for total federal student loans of $5,500. If the student borrows this amount, these loans will also be applied as payments to the bill, and the remaining estimated billed amount would be $20,182. (If you’re doing the math at home, you’ll notice that this figure is $55 higher than you might expect—that is because Federal Direct Subsidized and Unsubsidized Loans have a 1% origination fee that the government deducts from the amount of the loan. Drake’s calculation for billed costs after loans accounts for this.)

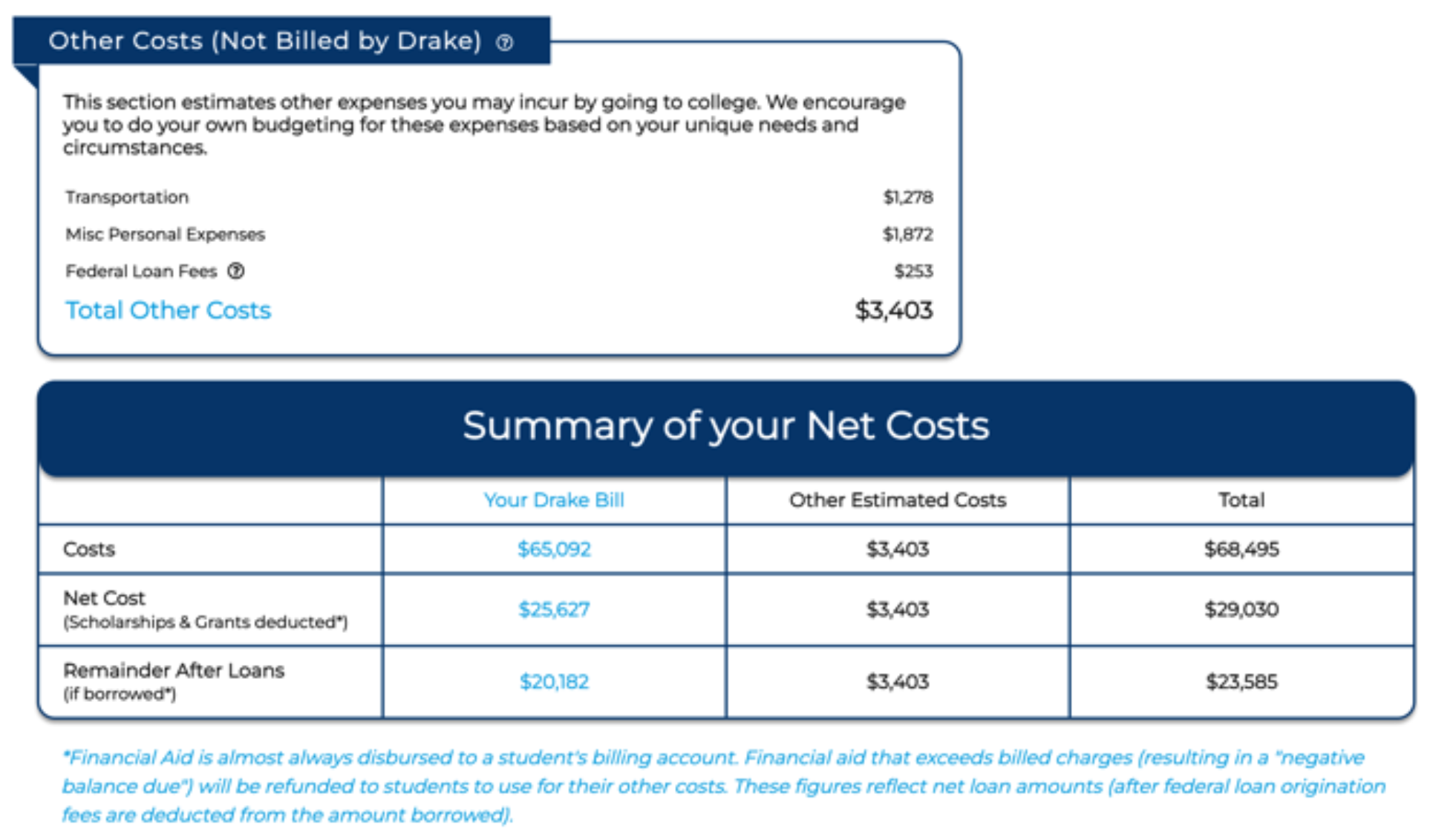

“Other Costs (Not Billed by Drake)” includes estimates of a student’s indirect costs. If a student thinks their indirect costs will be less than estimated, they can use their own estimates for planning purposes. If a student believes their indirect costs will be more than estimated, they could contact the financial aid office to request a cost of attendance budget adjustment. A student would need to provide rationale and documentation that supports the request.

Financial aid is applied to a student’s bill. If a student’s total financial aid exceeds their billed charges, the student will receive a credit balance refund that can be used to pay for their indirect costs.

- The “Summary of your Net Costs” section brings all of the foregoing sections of Drake’s financial aid offer together. For example:

- To find the estimated net cost, see the middle row, third column.

- To find the estimated net billed cost at Drake, see the middle row, first column.

- To find the remaining billed cost at Drake if they borrow the loans included on their aid offer, see the third row, first column.

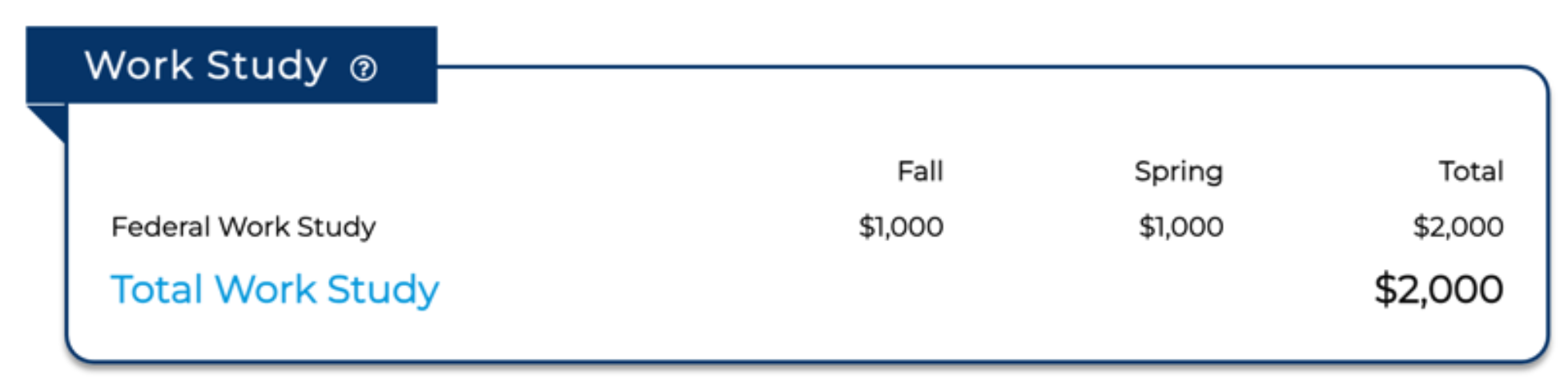

In this example, the student is eligible for Federal Work Study (FWS). Generally, students are packaged with $2000 of FWS or their maximum eligibility (whichever is less). Because FWS must be earned, it is not readily available to pay a student’s bill and is therefore not included in the foregoing remaining cost calculations. At Drake, students are paid FWS earnings once per month, based on the hours worked the previous month. Students can use these earnings to make payments on their bill or to pay for their indirect costs.

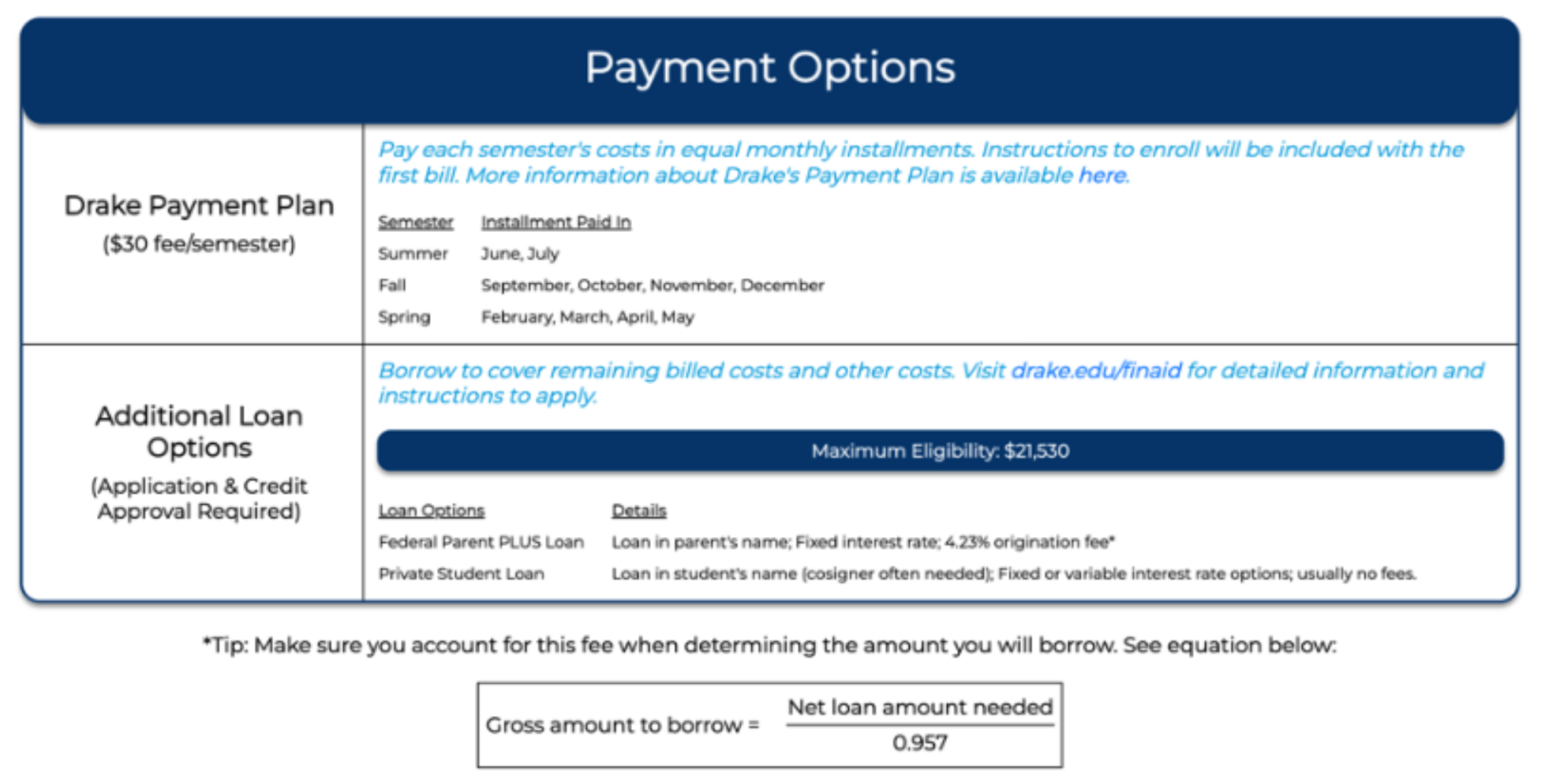

The final section of Drake’s financial aid offer provides options to pay any remaining charges on the bill or to secure financing for both billed and indirect costs. Drake’s payment plan allows students to pay remaining billed costs for a semester in equal monthly installments (for a $30/semester fee). This example is based on an enrollment period of fall and spring semesters, and so under Drake’s payment plan the estimated remaining billed costs on this aid offer could be divided into 8 equal monthly installments.

Students are encouraged to always borrow their eligibility for federal student loans first. If families need additional loans to cover remaining costs (including indirect costs), there are options available. These loan options do require application and credit approval, and there are two main categories: Federal Parent PLUS Loans or private student loans.

The Federal Parent PLUS Loan is a loan for biological or adoptive parents of dependent students (as defined by the FAFSA), or for step-parents who are included in the parent section of the student’s FAFSA. The parent borrower must be a U.S. citizen or eligible non-citizen. Completion of the FAFSA and credit approval is required in order for a student to receive a Parent PLUS Loan, and the student must be enrolled at least half-time (6+ credits). This loan has an origination fee of 4.27% that is deducted from the amount borrowed. Due to this, parents will need to borrow an additional amount to cover this fee. Parent borrowers who are approved for the Parent PLUS Loan may borrow up to the student’s remaining cost of attendance. Parents may choose whether to begin repayment immediately, make interest-only payments while the student is enrolled, or defer all payments until the student leaves school. More information about the Federal Parent PLUS Loan can be found here.

Private student loans can be applied for through a lender of the borrower’s choosing. Many schools provide a “preferred lender list” that contains lenders the school recommends, based on its evaluation of the terms and service those lenders provide students. Terms of private student loans vary widely. Loans can offer fixed or variable rates, longer or shorter repayment periods, differing grace periods prior to repayment, and different borrower benefits. Students are encouraged to compare the terms offered to them from multiple lenders to find the best terms available.

Returning to this example, let’s suppose that the student will borrow the Federal Direct Subsidized and Unsubsidized Loans available, making the remaining billed costs estimate for the year $20,182. The student plans to borrow additional loans to cover these billed costs, and the student also needs an additional $1000 to cover the cost of a computer purchase. The student plans to cover any other indirect costs without the use of financial aid. Therefore, the total amount of additional loan funding needed for the year is $21,182. If the student’s parents wish to borrow a Federal Parent PLUS Loan, they will need to factor the origination fee into the amount they borrow, and so the gross amount they will request is $22,134 ($21,182 / .957). If the student pursues a private student loan (which typically do not have origination fees), the student would apply for $21,182. When the student’s financial aid has all disbursed, the student’s bill would be paid in full and the student should receive a credit balance refund totaling $1000 for the year ($500 each semester).